Florida is one of the least affordable states for personal auto insurance. In 2020, the average annual expenditure for auto insurance was $1,342 in Florida, more than 30 percent higher than the countrywide figure. Auto insurance expenditures were 2.39 percent of the median household income for the state. Only one state, Louisiana, was less affordable. As in the rest of the country, the pandemic-related decline in driving led to short-lived improvement in auto insurance affordability for Florida’s drivers. However, claim trends are pushing auto insurance rates higher once again, especially in Florida. According to an analysis of auto insurance rate quotes, Florida drivers are experiencing a 15 percent jump in quoted insurance rates in 2023, the largest increase in the nation.

Florida is one of the least affordable states in the nation for auto insurance, resulting from a culture of claim and legal system abuse.

Florida faces many of the cost drivers impacting the country as a whole: increasing auto claim severity, growing medical utilization, economic inflation boosting the costs of repairing and replacing vehicles, and litigation. However, unique features in Florida’s insurance system and a long-standing culture of claim and legal system abuse have allowed some medical and legal professionals to generate substantial income for themselves at a significant cost to Florida drivers. The Florida legislature first enacted the state’s no-fault auto insurance system in the early 1970s, with the goal of lowering insurance costs, speeding up the delivery of benefits to injured persons, and reducing litigation, especially for minor injuries. There have been many attempts to reform the system, including a period in 2007 when the no-fault system was allowed to sunset briefly and significant restrictions on PIP spending in 2012. Whether Florida maintains its no-fault system or reverts to traditional tort-based auto insurance, key aspects of the environment, such as one-way attorney fees and standards for bad faith, will continue to provide opportunities for abuse unless addressed by policymakers. Policymakers in the Sunshine State enacted substantial property insurance reform in late 2022 focusing on the affordability and availability crisis in homeowners’ insurance. Leaders have pledged to address similar issues in other lines of insurance to ease the financial burden that paying for auto insurance represents for Florida drivers. To help inform these public policy discussions, the IRC shares the following highlights from previously released IRC research and other publicly available sources.

Claim Cost Drivers Are the Key to Insurance Affordability

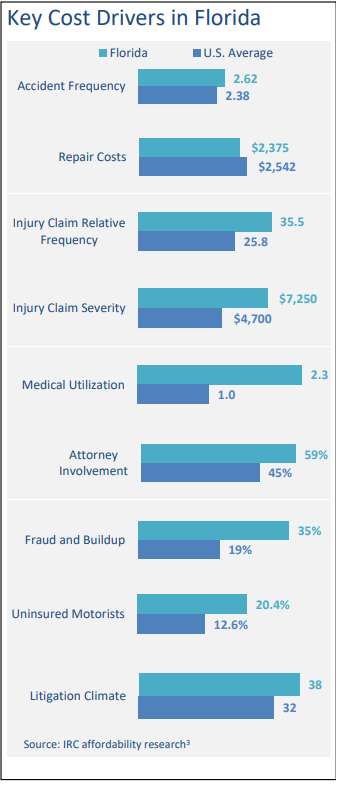

Efforts to improve auto insurance affordability must begin with the underlying cost drivers. In nearly every key cost driver, Florida costs are well above the national average.

Accident frequency: The number of property damage liability claims per 100 insured vehicles in Florida is 10 percent higher than the countrywide average.

Repair costs: For years, the average cost of a property damage claim was below the national average. However, evidence suggests that repair costs are increasing faster in Florida than elsewhere.

Injury claim relative frequency: Floridians show a greater propensity to file injury claims once an accident occurs, with a relative claim frequency 40 percent higher than the national average. Florida is the only no-fault state with an above-average ratio of bodily injury to property damage claim frequency.

Injury claim severity: The median amount paid per claim for auto injury insurance claims for all injury coverages combined is much higher in Florida than in the nation as a whole.

Medical utilization: Florida auto claimants are more likely than those in other states to receive diagnostic procedures, such as magnetic resonance imaging (MRI).

Attorney involvement: Florida claimants are more likely than those in other states to hire attorneys. Attorney involvement has been associated with higher claim costs and longer settlement times.

Fraud and buildup: The percentage of all auto injury claims with the appearance of claim fraud and/or buildup is evidence of Florida’s culture of fraud.

Uninsured motorists: Florida has one of the highest rates of uninsured motorists, both a symptom and a cause of affordability challenges.

Litigation climate: According to a survey of business leaders, Florida’s legal environment ranks near the bottom of state liability systems in terms of fairness and reasonableness.

Earlier PIP Reforms Failed to Reduce Overall Costs

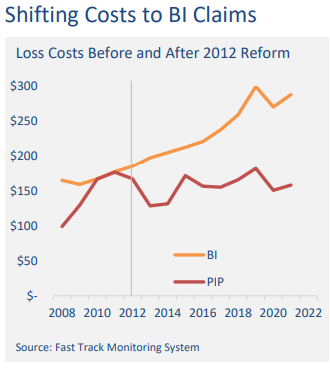

The 2012 no-fault reform, with its restrictions on expenditures under PIP coverage, was initially successful in reducing the rapidly rising PIP claim costs. Before the reform, the average loss cost for PIP claims peaked at $176 in 2011; it then declined during the next two years. However, some of the initial improvements in PIP claims reversed as participants adjusted to the new rules. Starting in 2014, claim costs resumed rising, reaching a new high of $182, before the pandemic slowdown.

Moreover, the nature of the reforms meant that costs were merely transferred to the third-party liability part of the system, as evidenced by the steady increase in the average loss cost for BI claims over the same period. In 2011, the BI and PIP average loss cost were nearly identical. Over the following years, the BI average loss cost grew significantly, reaching $299 in 2019.

Florida’s Unique Litigation Environment

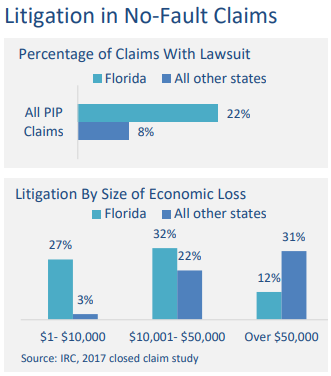

One of the stated goals for Florida’s no-fault system was to control insurance costs by reducing the amount of litigation in claim settlement, especially for less severe claims. However, not only is PIP litigation much more prevalent in Florida than in other states, less severe claims were more likely than more serious ones to result in litigation.

In the rest of the country, only 8 percent of PIP claims closed with payment resulted in a lawsuit being filed. The percentage in Florida was nearly three times higher: 22 percent.4 Moreover, the difference is especially stark among smaller claims—those in which the reported medical expenses, lost wages, and other economic losses totaled $10,000 or less. More than one quarter of these relatively minor claims in Florida resulted in litigation, compared with just 3 percent in other states. Among large claims (those with more than $50,000 in reported economic losses), Florida claims were less likely than those in other states to have a lawsuit filed.

Assignment of Benefits Create Opportunities for Litigation

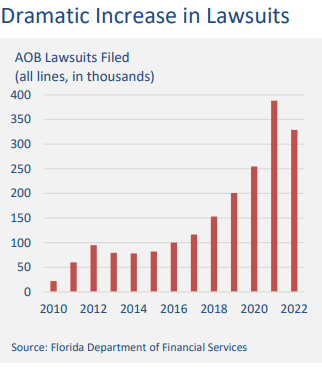

An assignment of benefits (AOB) in insurance occurs when a person who suffers a covered loss agrees to sign over their rights as a claimant to a third party, usually a service provider such as a construction company, auto repair shop, or medical professional. The third party then seeks payment directly from the insurance company and is granted the legal standing to file lawsuits against the insurance company over disputes about the claim. When coupled with Florida’s one-way attorney fees, the stage is set for claim and legal system abuse.

The number of AOB lawsuits in the state has skyrocketed in recent years, from fewer than 25,000 in 2010 to nearly 400,000 in 2021. 5 Some of these lawsuits stem from property or auto physical damage claims, but most are from medical providers seeking compensation under auto injury coverage. The 2022 reform addressed the problem of AOBs in property insurance but have no impact on their use in auto claims.

Claim Abuse and Litigation Add Costs to the System

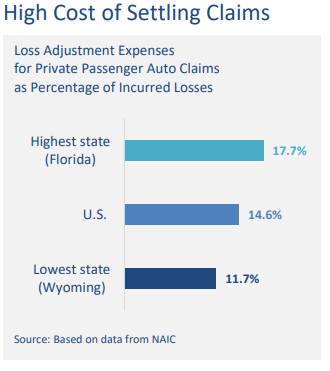

In addition to the reimbursement of insured losses, insurance companies must expend resources to handle claims. Loss adjustment expenses are the costs associated with the settling of insurance claims, including the insurance company's due diligence effort in establishing the legitimacy of a claim. Such costs may include investigation, appraisal, adjustment, and litigation expenses.

In states with a culture of claim abuse and high rates of litigation, these costs can be substantial. For private passenger auto in Florida, the ratio of loss adjustment expenses to incurred losses was 17.7 percent, the highest in the country and 22 percent higher than the national average. 6 In dollar terms, the extent to which Florida’s expense-to-loss ratio surpasses the national average translates into more than $500 million of excess spending on loss adjustment expenses as a result of the state’s claim environment.

Notes

- The most recent year of auto insurance expenditure data available is 2020, from National Association of Insurance Commissioners’ Auto Insurance Database.

- For example, see recent CBS new report.

- For more information about how these cost drivers are defined, see IRC’s 2022 report State Variations in Auto Insurance Affordability or 2021 research brief Auto insurance Affordability.

- Accident frequency: 2021 data from the Fast Track Monitoring System

- Repair costs: 2018 data from IRC’s study Patterns in Auto Physical Damage Insurance Claims

- Injury claim relative frequency: 2021 data from the Fast Track Monitoring System

- Injury claim severity: 2017 data from IRC’s closed-claim study. For more information about IRC’s closed-claim research, see Countrywide Patterns in Auto Injury Insurance Claims

- Medical utilization: 2017 data from IRC’s closed-claim study • Attorney involvement: 2017 data from IRC’s closed-claim study

- Fraud and buildup: 2012 data from IRC’s closed-claim study, reported in Fraud and Buildup and Auto Injury Insurance Claims

- Uninsured motorists: 2019 data from IRC’s Uninsured Motorists report

- Litigation climate: 2019 data from Institute for Legal Reform’s 2019 Lawsuit Climate Survey: Ranking the States

- 2017 data from IRC’s closed-claim study, reported in Auto Insurance Affordability: Cost Drivers in Florida.

- Based on data from Florida Department of Financial Services, Service of Process database.

- Based on calculations using data from National Association of Insurance Commissioners’ Report on Profitability by Line by State in 2021.