Research Publications

Auto Insurance Affordability

This report presents a new methodology for studying automobile insurance affordability and examines changes and differences in affordability over time and across states. The study also inspects the drivers of automobile insurance affordability.

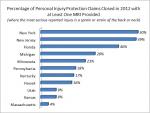

Interstate Differences in Medical Utilization in Auto Injury Claims

Based on a detailed review of more than 30,000 auto injury claims closed with payment in 2012, this report documents substantial differences across states in the utilization of key medical diagnostic and treatment services. The study examined utilization patterns for MRIs and CT scans, as well as for treatment provided by chiropractors and physical therapists. Documenting extreme variation in utilization patterns for similar types of claims suggests opportunities for improving the quality of care provided to auto injury claimants and reducing the cost of auto injury claims.

No-Fault Auto Injury Claims in Michigan: A Study of Closed Claims and Open Catastrophic Claims

This report identifies some of the key factors contributing to the large increases in PIP claim costs in Michigan from 2002 to 2011, examining changes in the composition of claimants and in treatment patterns among claims closed with payment. The study also pays special attention to the role of very large claims, with information collected on a sample of catastrophic open claims.

Trends in Auto Injury Claims, 2011 Edition

New findings from an Insurance Research Council (IRC) study of auto injury claim trends indicate that insurance claim costs countrywide have recently increased, reversing previous trends of declining or relatively stable costs. The report, Trends in Auto Injury Claims, 2011 Edition, documents important auto injury claim trends, both countrywide and by state, using private passenger auto claim data from national and state-level statistical reporting agencies.

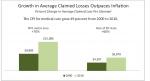

New York’s No-Fault System: Final Report on Closed Auto Injury Claims

New findings from an Insurance Research Council (IRC) study of personal injury protection (PIP) claims closed in 2010 show that claimed losses for medical expenses, lost wages, and other expenses related to injuries from auto accidents in the New York City area have risen 70 percent over the past decade, surpassing the 49 percent increase in medical care inflation over the same period.

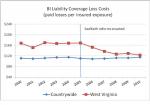

The Impact of Third-Party Bad-Faith Reforms on Automobile Liability Insurance Costs in West Virginia

According to a new study from the Insurance Research Council (IRC), third-party bad-faith reforms adopted by the West Virginia State Legislature in 2005 were estimated to have reduced underlying insurance coverage costs by approximately $200 million in the five-year period after the reforms were enacted.

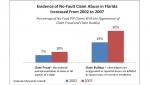

PIP Claiming Behavior and Claim Outcomes in Florida’s No-Fault Insurance System

Almost one in every three no-fault auto insurance claims closed in Florida in 2007 appeared to involve the exaggeration of an injury or to be inflated by unnecessary or excessive medical treatment, according to a new study from the Insurance Research Council (IRC). In addition, as many as one in ten no-fault claims appeared to be fraudulent, with material misrepresentation of some or all aspects of the claim, such as claims based on fictitious accidents.

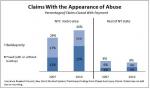

New York’s No-Fault System: Preliminary Findings From Closed Auto Injury Claims

About one in every five no-fault auto insurance claims closed in the New York City area in 2010 appears to have elements of fraud, and as many as one in three claims appears to be inflated, according to a new study from the Insurance Research Council (IRC). From 2007 to 2010, the percentage of no-fault claims in the New York City area with the appearance of claim abuse rose from 29 percent to 35 percent.

Hospital Cost Shifting and Auto Injury Insurance Claims

According to a new study from the Insurance Research Council, low reimbursements from public health insurance programs, such as Medicare and Medicaid, have prompted hospitals to shift costs to automobile insurance companies—raising auto injury claim costs and forcing auto insurers to more closely scrutinize and negotiate hospital bills prior to payment.

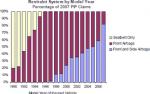

Vehicle Characteristics and Auto Injury Claims

A new study by the Insurance Research Council (IRC) details the steady incorporation of front and side airbag systems in motor vehicles and documents the beneficial impact of this trend on auto injury insurance claim costs. The study examined the type of passenger restraint system found in insured vehicles in a sample of 2007 closed auto injury insurance claims and looked at differences in the extent of injuries and subsequent claim payments. The report found a rapid transition from seat belts only to front and side airbag systems as model years advanced within the sample of vehicles involved in 2007 personal injury protection (PIP) claims. Among vehicles from model year 1990, 80 percent had seat belts but no airbags, and 20 percent had front airbags. Among 1998 model year vehicles, all vehicles were equipped with airbags—89 percent had front airbags only and 11 percent also included side airbags. Among vehicles from model year 2007, 82 percent had front and side airbags.

- Purchase PDF (125.00)

- Purchase Printed (140.00)

- View News Release