Research Publications

Auto Insurance Telematics: Consumer Attitudes and Opinions, 2022 Edition

This report expands on previous IRC research on consumer attitudes and opinions with respect to personal auto insurance telematics and usage-based insurance (UBI). The report finds that more U.S. drivers are open to opting into UBI programs to save on their auto insurance premiums. Yet, more widespread acceptance of telematics programs and UBI remains limited for various reasons, including privacy concerns. Findings also confirm that Telematics programs provide the opportunity for safe drivers to lower their insurance costs and can improve overall road safety.

Report Summary:

Public Opinions on Credit Scoring and the Use of Credit-Based Insurance Scores

The focus of this study is the public’s knowledge of and attitudes on issues around credit history, credit scores, and the use of credit-base insurance scores as an insurance rating factor. It also looks at perceptions of auto insurance affordability. The results are based on an online survey with more than 7,000 respondents.

Report Summary:

State Variations in Auto Insurance Affordability

This research expands on previous IRC research on personal auto insurance affordability. IRC measures affordability with the ratio of auto insurance expenditures to median household income. The report shows countrywide trends and depicts the relationship between individual cost drivers and statewide affordability. Individual state pages focus on specific cost drivers affecting each state.

Report Summary:

Public Attitudes on Litigation Trends and the Role of Attorneys in Auto Insurance Claims

This study examines public attitudes on issues around litigation and the impact on insurance. Through an online survey with more than 1,500 respondents, the Insurance Research Council examined consumer perceptions of attorney advertising, litigation financing, the role of attorneys in insurance claims, and issues relating to personal injury lawsuits. One focus of the report is generational differences in attitudes toward these topics.

Report Summary:

Uninsured Motorists, 2021 Edition

This study examines trends in the percentage of uninsured motorists in each state based on uninsured motorists and bodily injury claim frequencies from 2015 through 2019. This report includes previous estimates beginning in 1999.

Consumer Responses to the Pandemic and Implications for Insurance

This study reports the findings from an October 2020 survey examining changes in commuting patterns, changes in personal risk exposure, and other topics related to the COVID-19 pandemic and its economic effects. Many of the impacts were more commonly reported among younger, urban, and lower-income respondents.

Patterns in Auto Physical Damage Insurance Claims

The report presents findings from a large collection of claims closed in 2010, 2014, and 2018 under private passenger comprehensive, collision, and property damage liability coverages. Claim information, such as payment details, vehicle age, cause of loss, attorney involvement, and policy deductibles and limits, is presented over time and across states.

Auto Insurance Affordability: Cost Drivers in New York

This report continues the IRC’s examination of key cost drivers in selected states. The specific factors driving high insurance claim costs can vary from state to state. This report looks specifically at injury claim severity, the impact of unlimited benefits, medical treatment, and attorney involvement.

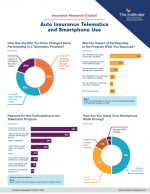

Auto Insurance Telematics & Smartphone Use: Consumer Survey Report

This report explores consumer attitudes and opinions with respect to auto insurance telematics and usage-based insurance. The report finds that many drivers participating in the programs change their driving behavior in response to information provided by their insurance companies about their driving gathered with a telematics device. The report also confirms that many drivers are concerned about the privacy of their personal information.

Attitudes on Home and Vehicle Ownership

This report summarizes findings based on a recent survey conducted on behalf of the IRC regarding

personal auto, homeowners, and renters insurance. The survey sample of 2,000 adult respondents was

representative of the United States’ general population with respect to age, gender, income, and region.