Research Publications

PIP Claiming Behavior and Claim Outcomes in Florida’s No-Fault Insurance System

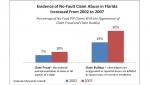

Almost one in every three no-fault auto insurance claims closed in Florida in 2007 appeared to involve the exaggeration of an injury or to be inflated by unnecessary or excessive medical treatment, according to a new study from the Insurance Research Council (IRC). In addition, as many as one in ten no-fault claims appeared to be fraudulent, with material misrepresentation of some or all aspects of the claim, such as claims based on fictitious accidents.

New York’s No-Fault System: Preliminary Findings From Closed Auto Injury Claims

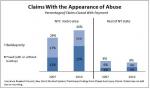

About one in every five no-fault auto insurance claims closed in the New York City area in 2010 appears to have elements of fraud, and as many as one in three claims appears to be inflated, according to a new study from the Insurance Research Council (IRC). From 2007 to 2010, the percentage of no-fault claims in the New York City area with the appearance of claim abuse rose from 29 percent to 35 percent.

Public Attitude Monitor 2010, Texting While Driving

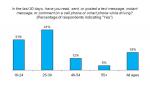

Almost one-in-five drivers in the United States (18 percent) reported texting while driving in the last 30 days according to a new survey from the Insurance Research Council (IRC). Younger drivers were much more likely than older drivers to say that they were texting while driving. Forty-one percent of drivers age 25 to 39, compared to only 5 percent of drivers 55 and older, reported texting while driving. Thirty-one percent of drivers age 16 to 24 said they had texted while driving in the last 30 days.

State Beach and Windstorm Plans, October 2010

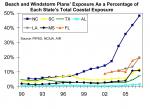

A new study from the Insurance Research Council (IRC) describes how the role of beach and windstorm plans in some states has changed from serving as a market of last resort, to providing unintentional incentives for economic development in areas vulnerable to severe wind damage. The report explains how state-run plans interact with voluntary homeowners insurance markets and describes how each of the five state beach and windstorm plans (Alabama, Mississippi, North Carolina, South Carolina, and Texas) and two statewide plans (Louisiana and Florida) would weather a hurricane catastrophe. The study reviews each plan’s growth in insured exposure from a theoretical perspective. Individual state case studies analyze each plan's origin, operational framework, and financial structure, along with overall residual market health in each state.

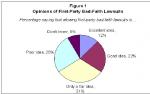

Public Attitude Monitor 2010: First-Party Bad-Faith Legislation

New public opinion survey findings from the Insurance Research Council (IRC) indicate that a majority of Americans believe that adopting new laws allowing people to sue their own auto insurance company for punitive damages, in addition to receiving benefits for their insured claim losses, is not a good idea. Twenty-six percent of those surveyed said that allowing such lawsuits was a poor idea, and 31 percent said it was only a fair idea.

Hospital Cost Shifting and Auto Injury Insurance Claims

According to a new study from the Insurance Research Council, low reimbursements from public health insurance programs, such as Medicare and Medicaid, have prompted hospitals to shift costs to automobile insurance companies—raising auto injury claim costs and forcing auto insurers to more closely scrutinize and negotiate hospital bills prior to payment.

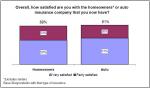

Public Attitude Monitor 2009, Insurance Satisfaction and Shopping

An overwhelming majority of consumers with auto and homeowners insurance are satisfied with their insurance companies, according to a new public opinion study by the Insurance Research Council (IRC). Ninety-one percent of respondents with auto insurance said that they were either very satisfied (61 percent) or fairly satisfied (30 percent) with their current auto insurer. Eighty-nine percent of homeowners said that they were either very satisfied (56 percent) or fairly satisfied (33 percent) with their homeowners insurance company.

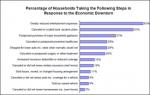

Public Attitude Monitor 2009, Consumers Response to the Economic Downturn

A new study by the Insurance Research Council (IRC) finds that many Americans have taken steps to reduce personal insurance costs in response to the economic downturn, but that maintaining essential auto and homeowners coverage remains a priority for the vast majority of consumers. Twenty-eight percent of those with auto insurance coverage surveyed for the study reported shopping for lower rates when they normally would not have done so. Among those with auto or homeowners insurance, 15 percent said they had increased their insurance deductibles or reduced the amount of coverage in order to reduce premium costs.