Research Publications

Public Understanding of Hurricane Deductibles: Need for Consumer Education Persists

This report examines public understanding of the nature and effects of hurricane deductibles and other special deductibles applicable to storm-related homeowners insurance claims. The study is based on a survey of privately-insured homeowners in five coastal states.

Attorney Involvement in Homeowners Insurance Claims in Texas

This study examines a sample of closed homeowners insurance claims for property damage occurring from 2008 to 2013, exploring the distribution of the number of claims and the dollars paid across regions within the state. The rate of attorney involvement is examined, with particular focus on claims stemming from wind and hail damage. The report documents the spread of attorney involvement across counties in Texas and provides estimates for the impact of continued increases.

Motivation for Attorney Involvement in Auto Injury Claims

This study examines the role of attorneys in the process of settling auto injury claims. In an on-line survey, respondents injured in auto accidents were asked about their experience, including satisfaction with the claim process, their decision whether to talk to or hire an attorney, and the services provided by attorneys.

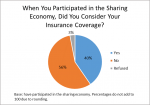

The Sharing Economy: Public Participation and Views

This study examines public familiarity with and participation in the sharing economy. Also explored in the report are various insurance-related aspects of the sharing economy. The study is based on the responses of 1,105 participants in a survey fielded by GfK Public Affairs & Corporate Communications.

Affordability in Auto Injury Insurance: Cost Drivers in Twelve Jurisdictions

Affordability in Auto Injury Insurance: Cost Drivers in Twelve Jurisdictions, June 2016, 132 pages.

This study identifies and documents the common and unique factors and conditions underlying rising auto injury insurance claim costs in 12 jurisdictions (Delaware, District of Columbia, Florida, Kentucky, Louisiana, Michigan, Mississippi, Nevada, New Jersey, New York, Rhode Island, West Virginia).

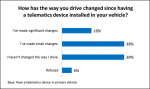

Auto Insurance Telematics: Consumer Attitudes and Opinions

The report explores consumer attitudes and opinions with respect to auto insurance telematics and usage-based insurance (UBI). The report finds that many drivers participating in telematics programs change their driving behavior in response to information provided by their insurance companies about their driving that was gathered with a telematics device. The report also confirms that many drivers are concerned about the privacy of their personal information.

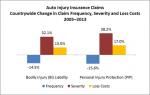

Trends in Auto Injury Claims, 2015 edition

This report examines the frequency, severity and loss costs associated with auto injury insurance claims under bodily injury liability and personal injury protection coverages, from 1990 to 2013. Countrywide and individual state outcomes and trends are analyzed.

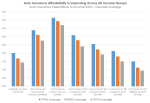

Trends in Auto Insurance Affordability

This report monitors auto insurance affordability across states and over time using the IRC’s auto insurance expenditure-to-income ratio. The study also analyzes auto insurance affordability trends for low-to-moderate income consumers and inspects differences in affordability trends across various goods and services considered necessities.

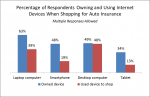

Shopping for Auto Insurance and the Use of Internet-Based Technology

This report examines how often consumers shop for auto insurance, how they go about shopping, the choices made after shopping, satisfaction with the shopping experience, and the use of Internet-based personal technology when shopping for insurance. The report also looks at differences in shopping behavior and technology use across demographic groups

Trends in Homeowners Insurance Claims, 2015 Edition

This report documents homeowners insurance claim frequency, severity, and loss cost trends from 1997 to 2013. Special emphasis is given to the role of catastrophe-related claims. Countrywide and state findings are presented.