Research Publications

Auto Insurance Affordability: Cost Drivers in Florida

The report combines information from IRC closed-claim research and other sources and is part of IRC’s ongoing research into the factors driving the affordability of auto insurance.

Auto Insurance Affordability: Cost Drivers in Louisiana

The report combines information from IRC closed-claim research and other sources and is part of IRC’s ongoing research into the factors driving the affordability of auto insurance.

Autonomous Vehicles and Transportation Network Companies: Public Attitudes and Opinions

This survey report explores the opinions about autonomous vehicles and transportation network companies.

Third-Party Bad Faith in Florida's Automobile Insurance System, 2018 Update

A report updating findings on the impact of Florida’s third-party bad-faith legal environment on BI liability auto insurance claim trends.

Digitizing the Auto Insurance Customer Relationship

This survey report explores the degree to which auto insurance customers interact with their insurer using digital methods and their preferences for using digital methods in the future.

Countrywide Patterns in Auto Injury Claims

This closed claim study is based on a sample of more than 80,000 auto injury claims paid in 2017 and examines trends in claim patterns, including injuries, medical treatment, claimed losses and payments, the claim settlement process, and attorney involvement. The report compares 2017 data to results from similar studies conducted in 2012 and earlier.

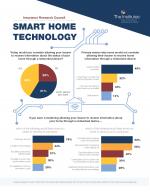

Smart Home Technology: Many Express Interest, But Cost and Privacy Concerns Slow Adoption

Smart Home Technology: Many Express Interest, but Cost and Privacy Concerns Slow Adoption, This study finds that nearly half of all homeowners and renters countrywide would consider allowing their insurance company to receive information about the status of their home through a smart home device or system. The study also identified attitudes and concerns that discourage some from participating in programs involving insurers.

Uninsured Motorists, 2017 Edition

This study examines trends in the percentage of uninsured motorists by state and countrywide. This edition of the report updates trends with new data for the period 2013-2015.